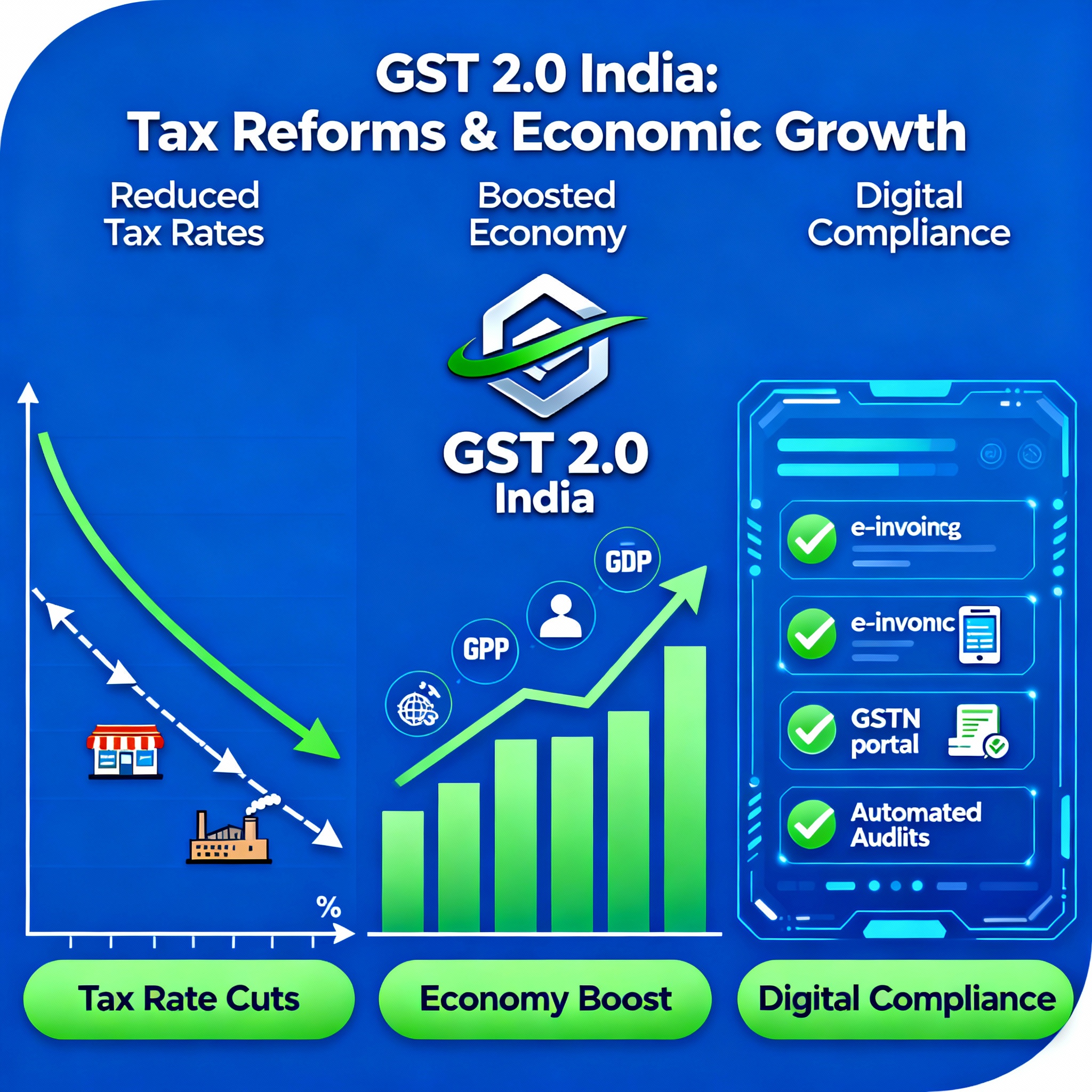

GST 2.0: How the New Tax Reform is Cutting Costs Across India

What is GST 2.0?

GST 2.0 marks a major overhaul of India’s indirect taxation system, officially launched on

September 22, 2025, after the 56th GST Council meeting led by Finance Minister Nirmala Sitharaman.

It simplifies the structure to only two main slabs—5% and 18%, while a 40% rate applies

to luxury and sin goods. The reform ensures transparency, lowers tax burden, and streamlines compliance for businesses. mmm A

The Key Changes Introduced in 2025

- Reduction from four GST slabs to two: 5% for essentials and 18% for other goods.

- 40% GST on luxury and sin goods to maintain revenue neutrality.

- Complete exemption on life and health insurance policies.

- Lower GST on daily essentials—UHT milk, paneer, soaps, shampoos, and two-wheelers.

- Pre-filled returns, simplified registration, and quicker refunds for small businesses.

These changes have led to record festive sales during the “GST Bachat Utsav 2025”,

with prices falling for over 50 essential items.

How GST 2.0 Cuts Costs for Consumers

With GST 2.0, the average household is saving over 4% per month on essential items.

The streamlined tax structure has reduced cascading taxation, meaning consumers no longer bear

additional costs along the production chain.

Benefits for Businesses and MSMEs

GST 2.0 is a boon for small and medium enterprises. It accelerates refund processing,

lowers compliance costs, and enhances liquidity.

The upcoming Goods and Services Tax Appellate Tribunal (GSTAT) will improve dispute resolution efficiency.

Sector-Wise Impact: From Essentials to Automobiles

| Sector | Old GST Rate | New GST Rate | Benefit |

|---|---|---|---|

| Essential Goods | 12% | 5% | Prices of food, soap, and FMCG down |

| Electronics | 28% | 18% | Smartphones, TVs, and ACs got cheaper |

| Automobiles (Small Cars) | 28% | 18% | Boosted car and bike sales |

| Renewable Energy Devices | 12% | 5% | Encouraged green transition |

| Agriculture Machinery | 12% | 5% | Reduced farming costs |

Digital Ease and Compliance Simplification

GST 2.0 introduces AI-powered pre-filled forms and real-time credit verification via blockchain.

Small traders can complete registration digitally, cutting compliance costs by up to 30%.

Expert Views and Future Outlook

Finance Minister Nirmala Sitharaman called GST 2.0 an

“empowerment tool for Indian families and businesses.” Economists predict India’s GDP could see

a 0.5–0.7% growth boost from improved consumption and SME expansion.

Conclusion

GST 2.0 is reshaping India’s economy with lower tax rates, digital simplicity, and stronger

business growth. It represents a move toward a

simplified, consumer-first tax system that benefits everyone—from individuals to industries.